It’s game on!

Novate a new Hyundai and go in the draw

The most anticipated event on Australia’s sporting calendar is almost here and you could catch all the action in person. LeasePlan and Hyundai are giving you the chance to catch footy’s biggest game and go in the draw to win a 2024 AFL Grand Final package for two worth $6250!

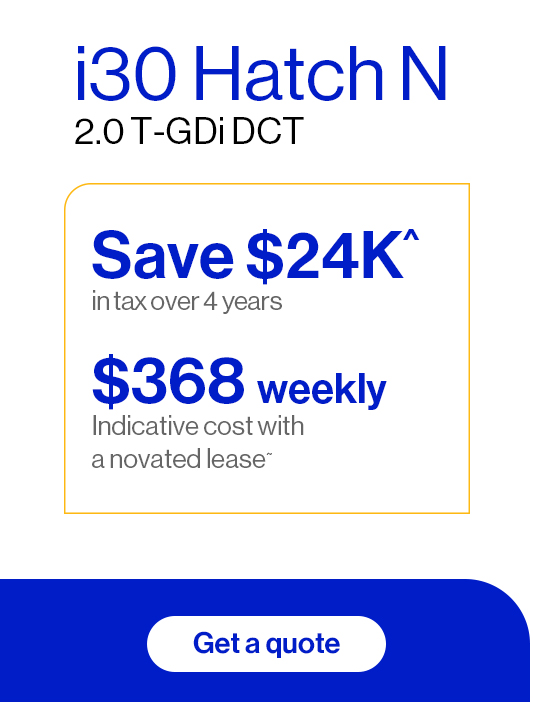

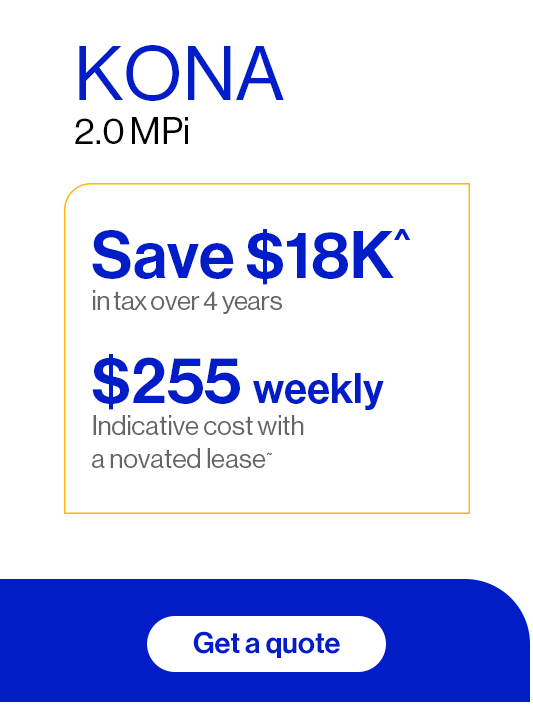

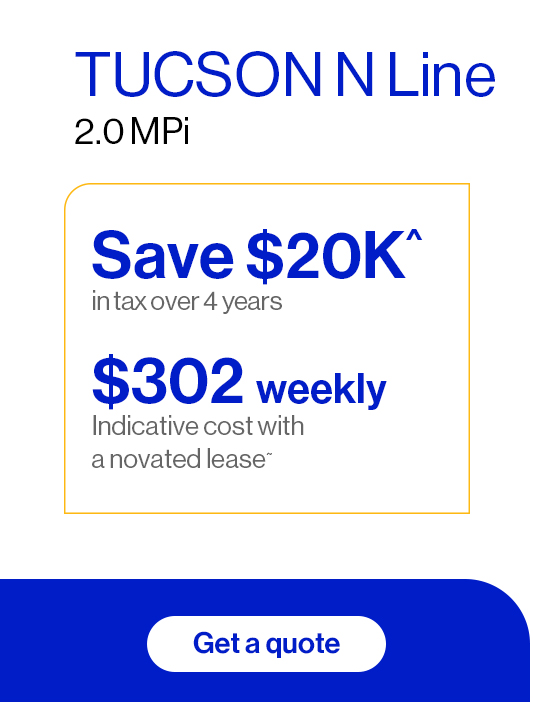

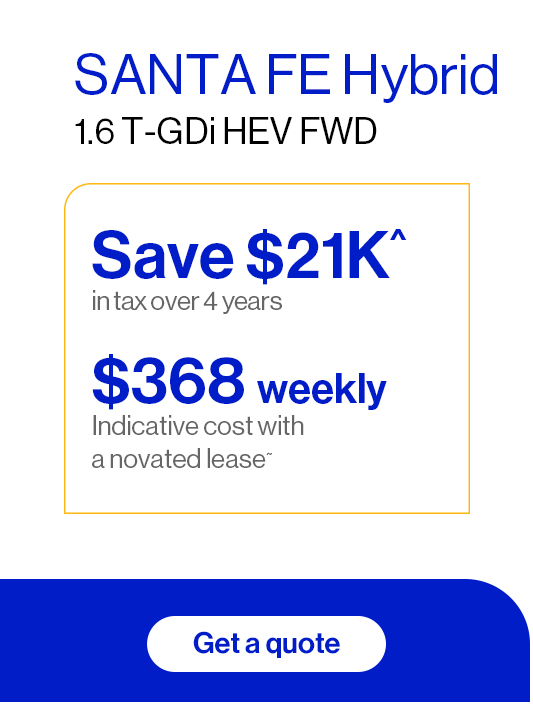

All you have to do is novate a new Hyundai by 30 August 2024#. Whether you’re looking for a small car for the city or a bold SUV for the open road, now is the perfect time to novate a brand new Hyundai. With their futuristic styling, latest high-tech advancements, and category-leading safety features, it’s no wonder the Hyundai range has been recognised with a suite of awards and accolades. Explore some of the most popular Hyundai models below to get started.

What's up for grabs?

From 1 July - 30 August 2024:

1. Novate any new Hyundai car

2. Go in the draw to win

- 2 tickets to the 2024 AFL Grand Final

- 2 nights’ accommodation at a 5-star Melbourne hotel

- 2 return flights to Melbourne

- $250 spending money

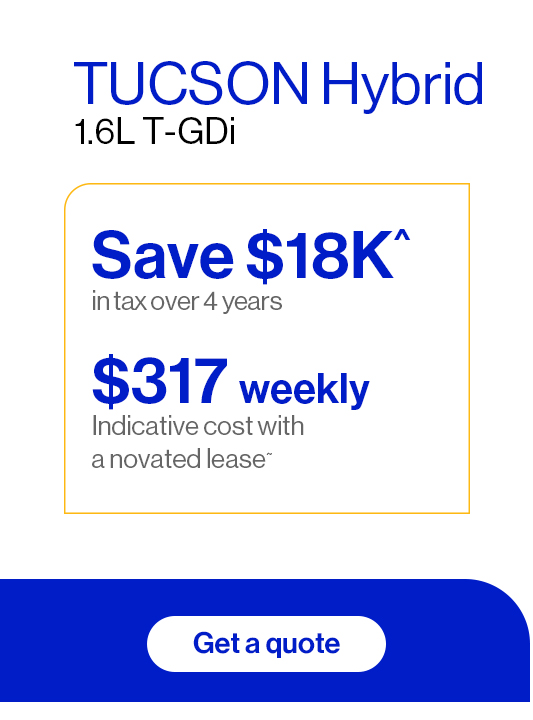

Save thousands on your new Hyundai