Newsflash: two of Kia’s high-end EVs now come without the luxury price tag, qualifying them for government EV incentives that take the savings into the stratosphere.

In the off-road field, Mitsubishi adds two new-generation Tritons no longer frightened away by novated leasing payload limits.

Plus, a re-evaluation by VW unlocks four extra models from its popular Amarok range, including entry-and-middle-tier grades.

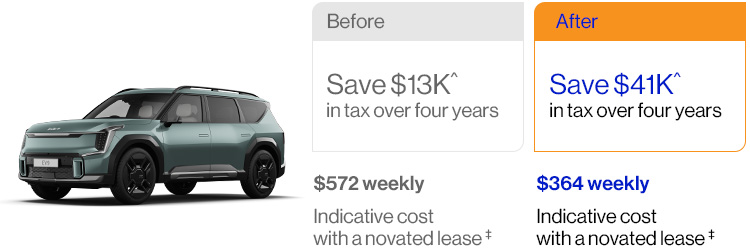

Kia EV9 Air

This is a game-changer if you’re playing in the 7-seat SUV space. The prize on offer? 2024 World Car of the Year and Drive Car of the Year 2024, now with supreme savings.

Kia has now increased the discount for novated buyers to bring the EV9 Air grade under the EV Luxury Car Tax threshold. This makes it exempt from Fringe Benefits Tax (FBT)#, meaning your car’s finance and running costs will be paid entirely from your pre-tax salary. The tax savings stack up to thousands each year of your lease.

Described by the brand as its “most advanced Kia yet”, EV9 pushes limits. Its head-turning sculpted body type reduces drag for a more aerodynamic performance. Personalised seat and mirror positioning is activated by fingerprint recognition (yes, really). A seamless panoramic digital display unites driving data, cabin settings, and infotainment with drag & drop widgets. Over-The-Air (OTA) updates push refreshed software and maps directly to the vehicle.

Tuned in Australia, Kia EV9 effortlessly handles our unique road conditions and can power on for up to 443km on a single charge.

Get a quote

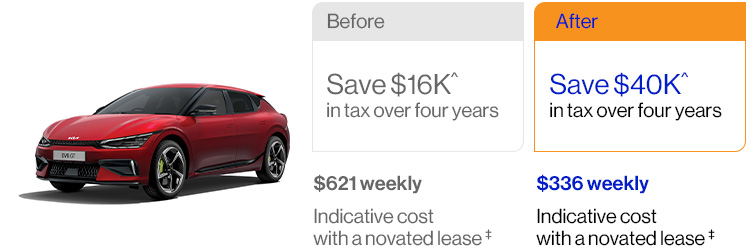

Kia EV6 GT

Driving enthusiasts, now you can attain the “most powerful Kia ever crafted” at a price tag below the Luxury Car Tax threshold for EVs. It means Kia’s ultimate performance EV offers the ultimate opportunity for income tax and GST savings, as 100% of payments will be made from pre-tax dollars (per the Aus Gov FBT exemption#).

This SUV beast accelerates 0-100km/h in 3.5 seconds. 430kW of power courses through its dual electric motors. Racing-inspired bucket-style seats with neon green accents conjure the track but don’t compromise on functionality, offering extensive lateral and back support.

Neon green mono-block brake calipers with integrated electronic booster work with 21" Michelin Performance tyres to enhance grip and braking performance. Locally tuned GT suspension and steering ensures tailored driving dynamics and handling. A 12.3-inch digital dash keeps the driver attuned to crucial driving information; beside it sits the combined 12.3" cluster display and 12.3" infotainment display for a seamless view. An 800V ultra high-speed charger gets you on the move fast, charging from 10 to 80% in 18 minutes.

Get a quote

The Kia EV experience

Hear from Kia Australia product expert Roland Rivero on what you can expect as a new Kia EV owner.

Enquire now

Volkswagen Amarok

Good news – all Amarok models are now eligible for novated leasing. This unlocks the base Core TDI405 4x4 (a very respectable option made for getting it done), as well as the mid-tier grades.

The Style 2.0L Diesel TDI500 variant ups the game with the inclusion of a stainless-steel sports bar, huge 12-inch digital infotainment touchscreen and 12.3-inch digital cockpit. Utes might be considered hard to park – but not in the Amarok Style, with 360-degree Area View and Park Assist Plus which steers you into a parking space hands free. The electronic parking brake gives a steadier hold for parking on inclines or while towing. There’s also a 3.0L V6 Diesel TDI600 variant.

The Amarok PanAmericana is ready to go wild in true style with roof rails, black exterior elements including alloys, all terrain tyres, 8-speaker Harman Kardon premium sound system and 10-way adjustable electric leather front seats. No matter which Amarok you choose, you get real-world capability on and off-road, designed here in Australia, and plenty of leg room thanks to the expanded wheelbase.

Mitsubishi Triton

Welcome back, Triton. Two grades now with payload options under 1,000kg meet ATO novated eligibility. Even sweeter, as an introductory offer Mitsubishi has bumped up the discount for novated buyers, with savings of up to $8,000 off the list price*.

Tritons deliver all-round capability. The tested-tough chassis and Super Select 4WD-II system achieve fantastic traction and performance on all terrain. You can shift on the fly between 2WD and 4WD at up to 100km/h using the drive selector dial. A 360-degree Multi-Around View Monitor provides a birds-eye view to help you park safely, while the super-square wheel arches are sure to turn heads.

The GLS boasts Hill Descent Control, glare-reducing electrochromic rear-view mirror and a tub liner. The top-line GSR adds a few luxuries like black alloys / exterior accents, heated front seats, and black sailplane. Known for its reliability, Triton is backed by a 10-year warranty – the longest in the current ute market. It’s also the benchmark for safety, as the first dual-cab ute to achieve a five-star ANCAP safety rating under the stricter 2024 regulations.

Get a quote